GW: Following the sad passing last December of Borosil’s Executive Chairman Mr B L Kheruka, what legacy did he leave behind within the company and the wider glass industry?

“Leave every place you visit in a better condition than it was when you entered.” This seemingly simple learning played a large part in all aspects of my grandfather’s existence. As he departed this life on 12 December 2021, he leaves behind a family that has strived to create a positive impact through all its members and two companies that have added tremendous value to all their stakeholders. He also leaves behind a shining path of values such as integrity, discipline, hard work and giving back, for all of us to follow. Finally, he leaves behind his love and passion in all of us.

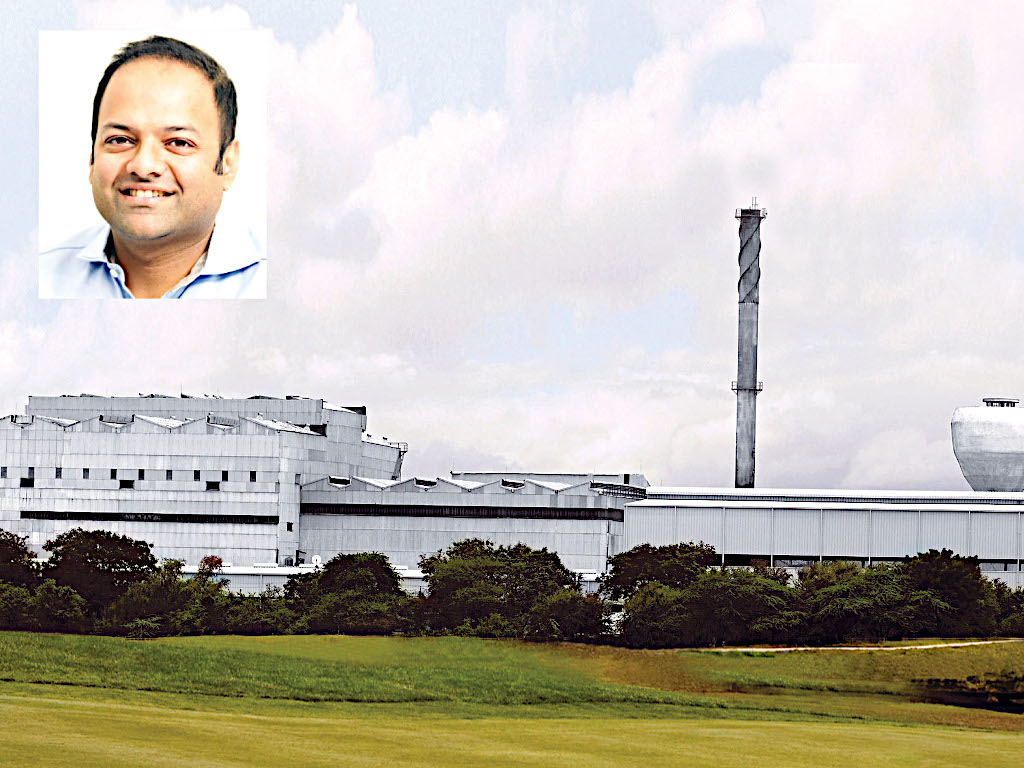

GW: What is the progress of the new brownfield solar glass plant being constructed at Borosil Renewables’ Bharuch facility in Gujarat?

The construction of the third furnace is in full swing and it is expected to get commissioned by July 2022. Our project team, the equipment suppliers, and associates working on project construction have done a commendable job to stay on the project schedule despite supply chain disruptions and various restrictions being faced in view of the ongoing Covid-19 pandemic. We hope there are no further challenges to the schedule!

GW: Following the doubling of Borosil Renewables’ capacity in 2016 and a further successful upgrade and expansion project in 2019, what is the motivation for the latest significant increase?

We more than doubled the capacity to 450tpd in 2019 from the earlier 180tpd in view of the increasing demand for solar glass in India and abroad. Due to a very positive outlook from governments across the world, the demand for solar power is increasing substantially. Moreover, the political and regulatory support for the creation of a robust domestic supply chain has created a conducive environment for domestic players like us. We firmly believe that domestic solar manufacturing industries in geographies like India, Europe, the Americas, Turkey, MENA, etc. are on the cusp of significant growth, and demand for solar glass in these geographies is expected to increase substantially. Since we have been catering to these markets and have long-term relationships with the customers, we were motivated to expand our capacity.

GW: What are the highlights of this investment?

This is a 550tpd integrated (from raw materials to tempered coated solar glass) solar glass manufacturing capacity being built with state-of-the-art technology from the best-in-class equipment suppliers. We have added several types of equipment in this expansion that will be compatible with changes that are expected to take in the solar industry in near future in terms of sizes, thicknesses, coatings, etc. This is a brownfield expansion and the available land, utilities and permits are already available. The team of professionals, contractors and equipment suppliers are largely the same that worked on our last expansion in 2019, and hence we are confident that we shall be able to complete the project within the estimated costs and timelines.

GW: Is it still your policy to adopt state-of-the-art technology from renowned international suppliers? Which partners were selected for the latest expansion?

We have been using state-of-the-art technology since the inception of our factory in 1994 when we successfully used the Pittsburgh process. We are now going for a 550tpd furnace and the design for the same has been sourced from a leading supplier of large furnaces. This furnace design uses a cross-fired technology for charging the fuel for glass melting and is expected to be very efficient and user-friendly. Moreover, such furnaces are expected to have a longer running life before they become due for a rebuild. The other equipment used for glass manufacturing and processing is also from very reputed global suppliers.

GW: And you were also recognised last year for the commercialisation of indigenous technology with an award from the Department of Science and Technology at the Government of India?

Last year, the Department of Science and Technology, Government of India honoured us with the National Award for 2021 for the development and commercialisation of indigenous technology. This is a very prestigious award and we are very proud of our team for this achievement. Innovation and continuous improvement in the areas of products and processes are the values ingrained in the DNA of the Borosil group and these are the main reasons for our survival and success as well as growth.

In Borosil Renewables Ltd. we have successfully been able to commercially develop the world’s first antimony-free solar glass. We are also the first company to develop the commercial capability to fully temper solar glass in 2mm thickness. Other recent product developments include the high efficiency ‘Shakti’ solar glass and ‘Selene’ Anti-glare solar glass.

This award is great recognition from the government of India and is a testimony to our efforts in developing new technologies and products. It is important to note the previous awardees for this recognition are very reputed industry names such as Reliance Industries, Larson and Toubro, Nuclear Power Corporation, etc. and it is our honour to join this prestigious league.

GW: What are the current and future prospects for the solar market in India and following the brownfield expansion, how well equipped will Borosil be to meet this sector’s needs?

The solar market is one of the fastest-growing markets across the world in terms of solar installations as well as manufacturing activity. With a very strong political will and regulatory support for domestic manufacturing, the solar module and component manufacturing in India is expected to grow manifold in near future. The installed manufacturing base of around 15GW per year of solar module capacity is expected to cross 50GW per year within the next three years. Borosil Renewables is very well placed to meet this demand as we have a strong relationship with the customers, a high-quality product, the global certifications for our glass, and our customers’ modules certified with our glass. Being a domestic supplier, we are able to offer certain unique benefits to our customers such as shorter delivery time, flexibility in terms of changes in glass sizes, ease of doing business, etc. With the upcoming expansion and the next set of expansions in the near future, we are very well equipped to meet the future demand.

GW: What is the strategy for future investment at Borosil Renewables?

We expect to complete the ongoing expansion by July 2022, taking the installed capacity to 1000tpd. We have obtained enabling approvals from our board for the installation of our 4th and 5th furnace at the same location with 550tpd, which are expected to get commissioned by Q4 of CY2023 and Q4 and CY2024, taking the installed manufacturing capacities to 2,100tpd which should be able to cater to solar module requirement of ~12GW per annum.

GW: How is the company structured to best serve the different sectors?

The board of Borosil Ltd. has approved the restructuring of the business of the Company into two separate listed entities by a composite scheme of arrangement. As you are aware, Borosil Ltd. operates two distinct businesses viz. consumer products and scientific products. The consumer business comprises glassware, non-glassware and Opalware product ranges for usage in the kitchen and for serveware, while the scientific business is made up of laboratory glassware, laboratory instrumentation and primary pharmaceutical packaging. Both the businesses have been functioning as separate profit centres with separate business heads and largely independent teams. Each is responsible for delivering on their own profit & loss and this has been the case for quite a few years now. Going forward, each of these businesses has distinct capital and operating requirements. The growth path and organic and inorganic growth potential is different, which entails different capital-raising requirements. Consequently, the scientific business will be demerged from the Borosil Ltd business. Pursuant to this demerger, Borosil Ltd will house the consumer products division of the company and the demerged scientific division will be housed in a separate company that is proposed to be named as Borosil Scientific Ltd. This company too will be listed on the National Stock Exchange as well as the Bombay Stock Exchange upon completion of this scheme. We expect that this scheme will further create value for all stakeholders of our company.

GW: How is Borosil Ltd, the household and laboratory glassware production business, performing?

Borosil Ltd houses our consumer products, scientific & industrial products, and pharmaceutical packaging businesses. Consolidated revenues for this business YTD Q3 2022 saw a very healthy growth of 54% compared to YTD Q3 2021. The EBITDA [earnings before interest, taxes, depreciation and amortisation] of the business grew to $16.61 million in YTD Q3 2022 from $8.88 million in YTD Q3 2021. These represent a strong operating result even with the harsh second wave of Covid that hit India very hard between April – June 2021.

Our consumer division (including glassware and non-glassware products) has seen a good bounce back in sales across all our key product lines. In fact, in each of our main categories, the sales during the nine-month period ended December 2021 exceed the sales for the entire 12 months of FY21.

Net sales of Scientific and Industrial products during the nine-month period ended December ’21 registered a growth of 35.5% over the same period last year. We have embarked upon a strategy to add new avenues of growth to supplement its domestic lab glassware by foraying into the export markets for lab glassware and introducing a range of lab instrumentation in India. Both these initiatives are beginning to contribute towards the healthier top-line growth of the scientific business.

Borosil’s vials and ampoules brand of pharma packaging products, Klasspack registered a sales growth of 61.7% over a nine-month period of the previous financial year.

GW: How would you describe prevailing market conditions in the sectors served by this business?

Despite a few variants of Covid emerging and there being a substantial rise in the number of cases, the impact has not been as severe as earlier waves, partly on account of the vaccination coverage. After a decline of maybe 8% in FY21, GDP growth for the country is estimated at 11% during this financial year. This bodes well for a recovery in demand.

Our consumer business has significant tailwinds for a few reasons. It is obvious that the larger theme of people upgrading their lifestyles from steel and melamine has continued towards the more contemporary glass. Secondly, with Covid lots of get-togethers have been at home over going to restaurants and that has definitely led to people improving their lifestyles at home. Thirdly, in general, people are increasingly aware of the environmental and health impact of many plastics and are therefore looking for substitutes. Glass is becoming an increasingly preferred alternative here. Finally, we have clearly seen a reduction in imports from China and that is due to high levels of freight. So, owing to all these factors, we certainly see domestic demand has become stronger.

The growth in the scientific and industrial products business was despite schools and colleges still remaining broadly closed and even government institutes having limited funding. However, on the flip side, pharmaceutical companies have been growing substantially and our presence in this segment has boosted our revenues from all three of our product categories viz. lab glassware, lab instrumentation as well as pharmaceutical packaging. There has also been a jump in our export sales of laboratory products owing to our world-standard manufacturing capabilities and I am happy to say that the number of countries we export to has increased exponentially.

GW: What have been the highlights of investment into Borosil Ltd’s manufacturing facilities since we last spoke in 2019?

We have already announced expansion projects for the consumer and scientific business during the first two quarters. Firstly, the project towards capacity expansion for Opalware production in Jaipur would take the capacity of our plant from 42tpd to 84tpd. Secondly, we are starting up the production of pressed borosilicate ware in India with an initial capacity of 25tpd, also at our Jaipur plant. We expect production of Opalware from the expanded capacity to commence sometime in the Q3 of CY22 and production for borosilicate glass press products to commence in Q2 of CY23. Finally, we have also announced an upstream project for the manufacture of glass tubing (due to uncertainty in the global supply chain as well as increased cost) with a capacity of 24tpd in Bharuch, which is likely to be commissioned by Q3 of CY23. The expansion of our production capacity for vials (close to double the existing capacity) and ampoules has also started and all orders to this extent have already been placed.

GW: In general across all Borosil’s operations, is investing in digital platforms still a priority to enhance manufacturing operations?

We have identified the potential of digital platforms and data for the businesses of Borosil Ltd and Borosil Renewables Ltd. We have either implemented or are in the process of implementing various digital solutions in the area of automation of the manufacturing process, improvement of the quality assurance process, the relevant CRM solutions and data analysis to make informed [investments]. We still have some ways to go to entirely achieve Industry 4.0; however, our team is committed to the same and we have been taking various steps in this direction.

GW: With Borosil having been recognised externally for its efforts in recent times, what importance is the company placing on sustainability?

The sustainability aspect has been at the very core of operations for Borosil. To give a few examples, the energy consumption of our solar glass manufacturing process is about 1100kCal/kg compared to ~1600kCal/kg that global leaders in solar glass are able to maintain as per our estimate. In addition, according to a life cycle assessment analysis carried out by a very reputed French institute, the carbon footprint of our operations is 22% lower compared to the default score of the glass industry. Moreover, other steps such as developing a toxin-free solar glass and employing reusable packing help make us more environmentally friendly.

As we all know, people are the key to any business. Our efforts on sustainability go beyond products and operations and we also focus on the well-being of all our stakeholders. We have been actively working on various initiatives in the area of water conservation, improvement of health outcomes for low-income citizens, female education, sports, etc. With the help of a very reputed organisation, we have been able to contribute towards a manifold increase to the income of farmers in the severe drought-affected Beed district of Maharashtra. Further, our employee policy that we announced during the Covid-19 pandemic to support the families of any deceased Borosil employees was considered an industry benchmark and was subsequently adopted by several leading Indian corporates.

To take these credentials to a next level, we are working on the development of the ESG [environmental, social and governance] roadmap and have identified critical areas where our teams would be working on to achieve the global benchmarks on various parameters of ESG.

GW: Following Mr B L Kheruka being awarded the prestigious C K Somany Award in 2019, what did it mean to Borosil to be the recipient last year of the AIGMF’s sister award, the Balkrishna Gupta Award for Exports?

We are truly thankful to AIGMF for honouring Borosil Renewables with the prestigious Balakrishna Gupta award for Exports. It is pertinent to note that when we started the business of manufacturing solar glass, it was primarily from the view of catering to the export market. Back in 2010, the Indian solar manufacturing industry was in its nascency. Even today, we export nearly 20–25% of our products to customers spread across various geographies such as Western Europe, the Americas, Russia, Turkey, MENA countries, etc. The sale in export markets helps keep us updated on various areas like emerging technology trends, quality requirements and also provides us with a risk diversification. We have been consistently meeting the requirements of our customers worldwide and have a long-standing relationship with them. Solar module manufacturing across the globe is expected to increase as the need of local supply chains is being felt in most of the geographies. With our existing presence in these geographies, exports are expected to grow significantly in the near future.

STOP PRESS: Borosil Renewables to acquire 100% stake in Interfloat: https://www.glassworldwide.co.uk/industry-announcements/borosil-renewabl...