The Senate in the US Congress has included a provision in a chamber-passed, but not yet approved, broad-based China Security bill that would re-open the tariff exclusion process, permitting companies and stakeholders to again request specific product exemptions for Chinese, and other in-place tariffs. The vast majority of initial tariff exemption requests were previously denied by the USTR under the Trump Administration. GPI will continue to follow the tariff process and any to-be-determined timelines, as Congress and the Administration address the issue into 2022.

Throughout the year, the Glass Packaging Institute (GPI) and its member companies follow a number of industry, customer and supplier packaging trends. In addition to the association’s primary reporting on the number of US glass bottles and jars produced and shipped each quarter, GPI closely monitors aggregate data for imports of empty glass containers (to be filled with product) by customer bases within the US.

For glass containers, similar to other commercially imported goods arriving to US ports of entry, customs procedures require a vessel’s manifest data to include details on all cargo for inspection, tariff assessment and other legal requirements. Glass containers for food and beverage packaging are collectively captured under a broad-based harmonised tariff schedule (HTS).

The broad glass container HTS code (7010.9050) can be broken down by size into sub-categories, and that information is then reported publicly through the US International Trade Commission (USITC) database. As the imports are reported out in size-only measurements, ultimate food and beverage end markets are not always apparent. For example, a 12oz [0.4l] bottle import could be filled with beer, flavoured alcoholic beverages, carbonated or non-carbonated beverages, and in a similar fashion, a 750ml bottle could be filled with either wine, spirits or even water.

Glass container import increases and tariff implementation

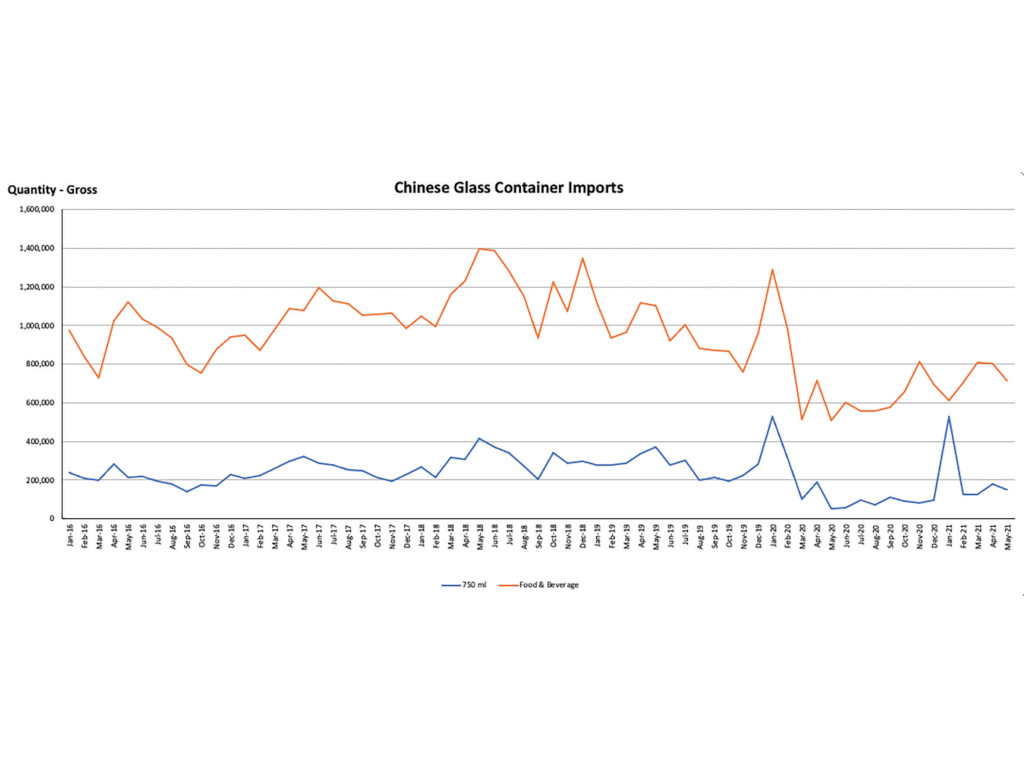

While reviewing the USITC import database, GPI and its member companies took notice of a significant increase in the import of glass containers from China beginning in 2016. Imports of all Chinese food and beverage empty glass containers increased by 11% in 2017, and by an additional 12% in 2018. During that time, several US-based shipment categories that GPI reports saw declines, despite relatively steady customer demand.

In the early part of 2018 the US government, through the Office of the US Trade Representative (USTR) took notice of the import surge from China as well and began to solicit stakeholder input. After careful deliberation, in August of 2018 GPI testified before the USTR in support of tariffs on Chinese glass container imports, in support of our North American member companies and workforce.

After numerous stakeholder and testimonial hearings, the USTR implemented a 10% tariff on a broad range of imported products from China, including glass containers. This went into effect in September of that year. After further discussion and input, that set of tariffs (commonly referred to as List 3 or Tranche 3), increased in duties from 10 to 25% in May of 2019.

Since Chinese tariff implementation began, GPI has closely followed the flow of Chinese glass container imports. In 2019, overall food and beverage glass container imports decreased by just over 19%, and last year were down 26%. Through May of 2021, those imports are down an additional 8%. Given the Covid-19 pandemic, resulting restrictions and overall impact on the import and export environment, it is difficult to discern how much of that decrease post-March 2020 is a result of the implemented tariffs.

Tariff impact and glass container import shift

While US shipments of glass bottles and jars cannot be directly correlated to Chinese imports, the association has seen positive trends through the first quarter of 2021 in several major categories. Beginning in 2019, several quarters saw shipment increases for many of the major food and beverage categories; wine, flavoured alcoholic beverages, non-alcoholic beverages and food among them. A future Glass Worldwide column will go into more detail on US shipments through the first half of 2021.

Post-tariff implementation, GPI has also looked for an import shift in empty glass containers from countries outside of North America. Of the largest volume countries, Taiwan’s glass food and beverage container imports increased 27% from 2020 to 2019, and through May, are up an additional 17%. While smaller in overall volume, similar import increases have been seen in the Philippines, Thailand and other countries near the Southeast Asian region. These, and other countries’ smaller import gains, have more than made up for the decrease in Chinese imports, with overall food and beverage glass container imports up 12% YTD.

What’s next for glass container imports and tariffs?

Since taking office in January, the Biden Administration has left the Chinese tariffs in place as they review the most current data, trends and imports fluctuations from around the world, with the hindsight and perspective of imports in some product categories having gradually decreased from China.

The Senate in the US Congress has included a provision in a chamber-passed, but not yet approved, broad-based China Security bill that would re-open the tariff exclusion process, permitting companies and stakeholders to again request specific product exemptions for Chinese, and other in-place tariffs. The vast majority of initial tariff exemption requests were previously denied by the USTR under the Trump Administration. GPI will continue to follow the tariff process and any to-be-determined timelines, as Congress and the Administration address the issue into 2022.